ONLINE DELIVERY

Global Specialists in Financial Intelligence

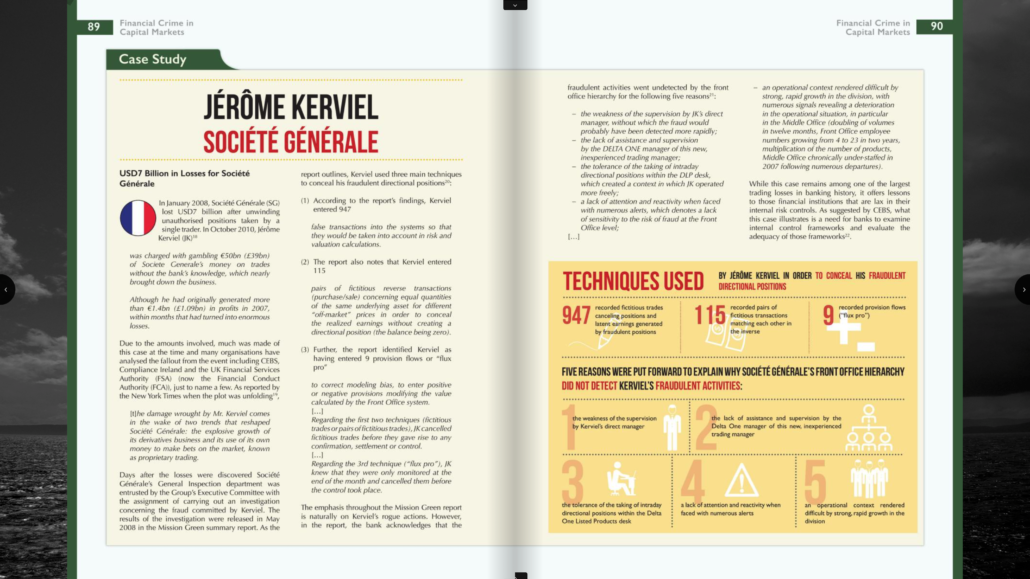

Unprepared investment dealers can suffer tremendous damage from financial crime and even face extinction if they do not have defences in place. To protect themselves, investment dealers around the world must manage the increased risk of securities fraud and adhere to AML and CTF compliance.

The FIU CONNECT (Capital Markets) program provides in-depth training to investment dealer staff on recognising and defending against financial crime vulnerabilities.

The FIU CONNECT (Capital Markets) program can be implemented with the following components:

- Digital textbook

- Computer-based training

- Examination